Author: John Li, Technology Analyst at IDTechEx

Since thermal cameras have been an automotive technology for 25 years and are still not prevalent, it’s clear that developments are required for them to become a common choice in ADAS sensor suites. Although over 1.2 million on-road vehicles have thermal LWIR camera technology installed, this is 0.08% of the estimated total of 1.5 billion vehicles on roads worldwide. This is in contrast to automotive radar, for which IDTechEx estimates that there is an average of over one radar unit per vehicle as of 2024, with typical SAE level 2 vehicles having 3 radars installed per car. For LWIR cameras to fill their potential in the automotive market, drivers in regulation and innovation are a requirement, leading to performance increases and cost decreases. In IDTechEx’s report, “Infrared (IR) Cameras for Automotive 2025-2035: Technologies, Opportunities, Forecasts”, these drivers are analyzed and accounted for in forecasts of LWIR camera volumes and market size over the next decade.

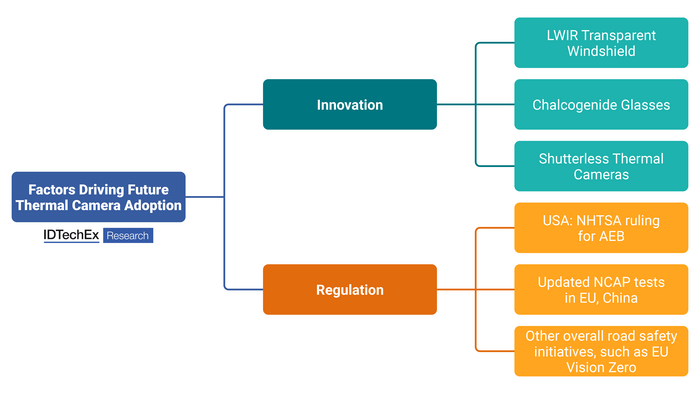

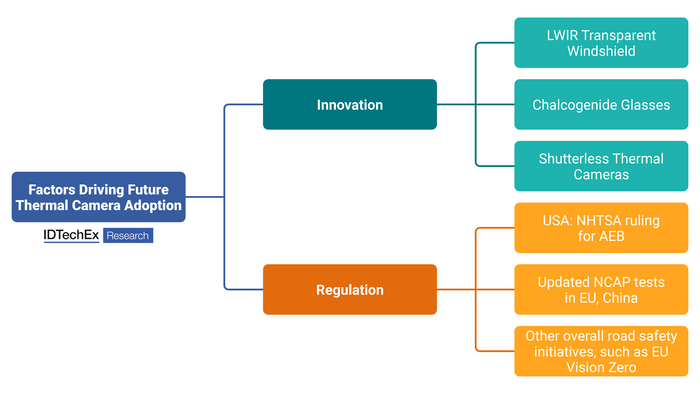

Drivers of LWIR camera adoption for automotive can be split up into regulation and product innovations. Source: IDTechEx

Regulations that could drive LWIR camera adoption have already begun, with updated NCAP programs in Europe and China updated this past year to include testing for AEB and tests in dark conditions. This means that improved night-time AEB performance is likely to contribute to a greater overall safety score for new vehicles. In addition, NHTSA’s US regulation for the passing of more stringent AEB tests, including vehicles, pedestrians, as well as lighting levels of below 0.2 lux, means that by 2029, IDTechEx expects LWIR cameras to service a portion of new vehicles in the US market to meet these harsher requirements.

On the side of product development and innovation, there have been significant strides since the first LWIR camera on the Cadillac DeVille in 2000, supplied by Raytheon. As of 2024, Teledyne FLIR, the largest thermal camera supplier, is on its fourth generation of cameras, with a fifth generation expected in 2025.

Since 2000, typical pixel pitch has decreased from 37µm to 12µm, which has a twofold effect on both cost and size. With a smaller pitch, the camera decreases in size significantly, allowing for flexible placement of the camera and less hassle in moving other components around to accommodate the camera. LWIR cameras require LWIR transparent lenses and optics. These are typically germanium, which, as of September 2024, costs almost US$3,900 per kg. It is also subject to harsh volatility, with current costs being approximately 37% higher than 9 months ago. However, due to the wavelength of LWIR radiation, the physical lowest limit of pixel pitch is being approached, and further decreases of pixel pitch to below 10µm will become very challenging.

LWIR transparent windshields

All current LWIR camera technologies are currently installed in the front grille of the vehicle. The main reason for this is that, unlike visible light cameras, LWIR light does not pass through glass and so cannot currently be installed inside the vehicle. This increases the design complexity of LWIR cameras: a heating ring element is required to melt frost when temperatures go below 0oC, washer jets are required to clean the camera, and a replaceable protective LWIR transparent window is required to protect the fragile lens from gravel and rocks kicked up while driving. If an LWIR camera could be installed behind the windshield, the temperature could be more closely controlled, cleaning could be achieved by using the windscreen wipers, and there is a reduced risk of objects damaging the camera.

IDTechEx is aware of two companies currently developing LWIR transparent windshields, which would enable these advantages to be realized, with IDTechEx expecting these products to enter the market in 2027. The downsizing of cameras means they are now small enough to be installed safely and non-invasively behind the windshield. Furthermore, the view from the higher vantage point of the windshield allows for a better view of the road and makes sensor fusion with visible light cameras much less complex, as the two cameras can be installed next to each other and their images overlaid with no parallax error. IDTechEx expects the development of LWIR transparent windshield sections to be a key factor in propelling the uptake of automotive LWIR cameras.

Overall, IDTechEx expects thermal cameras to become increasingly installed behind the windshield, as opposed to current integration methods into the front grille. Source: IDTechEx

Chalcogenide glasses

Going hand in hand with the development of LWIR transparent windshields is the potential of germanium alternatives that can act as LWIR transparent windows or be molded into lenses. Of the potential materials, chalcogenide glasses have emerged as a strong contender to take market share from germanium for infrared cameras. Chalcogenide glasses are formed from the chalcogen elements, such as sulfur and tellurium. Chalcogenide glasses are scalable, and the specific elemental composition and manufacturing processes can be used to adjust optical parameters such as refractive index. Furthermore, chalcogenides transmit a broader range of infrared light and have a superior thermoptic coefficient to germanium.

Most importantly, unlike germanium and other crystalline materials, chalcogenide glasses can be molded when heated to high temperatures (known as hot-forming) into the appropriate geometries, compared to single-point diamond turning processes for germanium, which are costly and time-consuming. The guarantee of cost-effective volumes of infrared optics will make them a more appealing option for automotive, as OEMs will be looking for large volumes of cameras to install into their ADAS sensor suites.

Using analysis of current product development and the value proposition of these enabling technologies in the methodology, IDTechEx forecasts the market for LWIR cameras to grow by more than ten times from 2025 to 2035, reaching approximately US$500 million. Further analysis of innovations and regulations, including technical considerations such as resolution and noise equivalent temperature difference, can be found in IDTechEx’s market report, “Infrared (IR) Cameras for Automotive 2025-2035: Technologies, Opportunities, Forecasts”.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/InfraAuto.

For the full portfolio of sensors market research available from IDTechEx, please see www.IDTechEx.com/Research/Sensors.